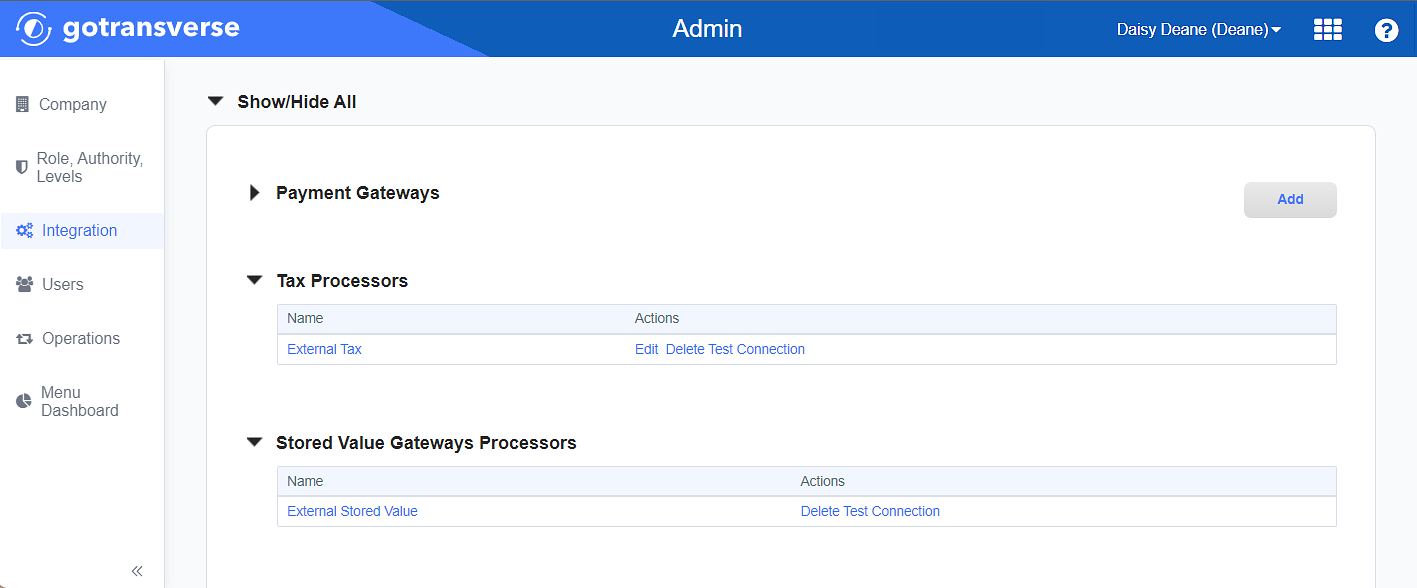

Tax Processors

The Tax Processors section is located in the Integrations module of the Admin application.

Tax Processors Section

Gotransverse supports the following types of tax processors:

-

Avalara Communications Tax Processor Integration — Calculates taxes based on Avalara's AvaTax for Communications software that determines and calculates taxes and fees for traditional telecommunication services as well as VoIP, internet services, cable and satellite TV, and other communications services. If you use the Avalara Communications tax rate provider, you can submit tax reports.

-

Avalara Tax Processor Integration — Calculates taxes based on Avalara’s SaaS-based AvaTax software for global location and jurisdiction-based sales tax calculations. A tax rate service provider such as Avalara Tax continually updates different tax rates so that taxes are calculated correctly.

-

External Tax Processor Integration (Tax Essentials) — Calculates taxes based on the configurations made in tax tables and tax table entries.

-

Flat Tax Processor Integration — Calculates taxes based on the same tax rate for every taxpayer regardless of the income bracket.

-

OneSource Tax Processor Integration — Calculates taxes based on OneSource software, which provides the consolidated tax determination, calculation and recording. OneSource Indirect Tax Determination directly supports US Sales and Use tax.

-

SureTax Communications Tax Processor Integration (SureTax) — Calculates taxes based on SureTax Communications software for services such as general sales, leasing, data, digital goods, and telecommunications and energy (utilities) services in “real-time”. Taxes are calculated based on ZIP+4 that is used for proper jurisdiction assignment and tax mapping.

-

Vertex Indirect Tax O Series Tax Processor Integration (Vertex) — Calculates and commits taxes based on Vertex’s Indirect Tax O Series software for sales tax. Vertex supports estimating taxes during an order, calculating taxes during invoice on order, calculating and committing taxes on invoices, and managing tax exemptions on the customer account level.

Gotransverse does not support all features of all tax processors. Please contact Gotransverse Support if you have any questions about tax processors and supported features.

Gotransverse performs tax estimates during order processing. Tax calculations are performed during invoice runs and are committed during invoice approvals. Tax rates are based on address information for the billing account and tax code information. The address is provided on the Account Details window at the billing and service levels. Gotransverse offers flexibility around determining which address (billing or service) is used based on the tenant’s configuration. The tax code stored on the price charge category is used as a code to indicate a tax for subscription services, add-on services, adjustments, and fees.

Gotransverse supports integrating custom tax scripts to provide the ability to adjust taxation based on custom logic. For example, a script could be created to leverage a given custom field as the indicator of tax jurisdiction. Refer to Tax Processor Scripts.