SureTax Communications Tax Processor Integration

Gotransverse supports the use of SureTax Communications tax processor for calculating and committing taxes. SureTax supports calculating taxes during an order, calculating taxes on invoices, and managing tax exemptions on the customer account level. With SureTax, taxes are calculated based on the ZIP+4 that is used for proper jurisdiction assignment and tax mapping.

Currently, SureTax does not support reissuing manual invoices without retax.

This tax processor does not support tax calculations for Manual Charges. An error will occur and prevent a user from creating a manual charge with the Submit for Taxation checkbox selected.

Review the following information before configuring the SureTax tax processor:

-

Ensure that you have a SureTax account. Log in to the SureTax website and obtain your account information to configure the Gotransverse Tax Processor.

If you want to calculate the estimated tax on order, ensure that the Calculate Tax During Order Billing system setting is set to True. Refer to System Settings for more information about changing system settings. -

Create at least one tax charge category. Refer to Charge Categories Module for additional information.

-

Sales Type Code is a required value in SureTax that must be provided for tax calculation purposes. To ensure a Sales Type Code is captured for each customer account in Gotransverse, create an account custom field (refer to Add Custom Field for additional information):

-

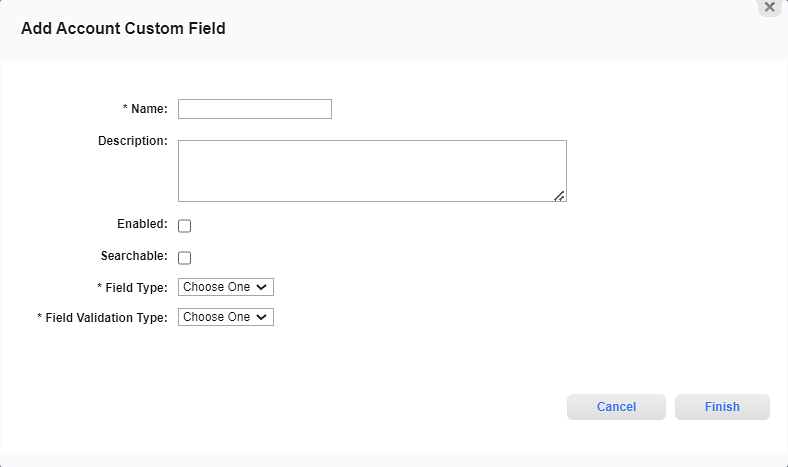

Create an account custom field of Text Field or List type, with Field Validation Type set to Text.

Add Account Custom Field Window

-

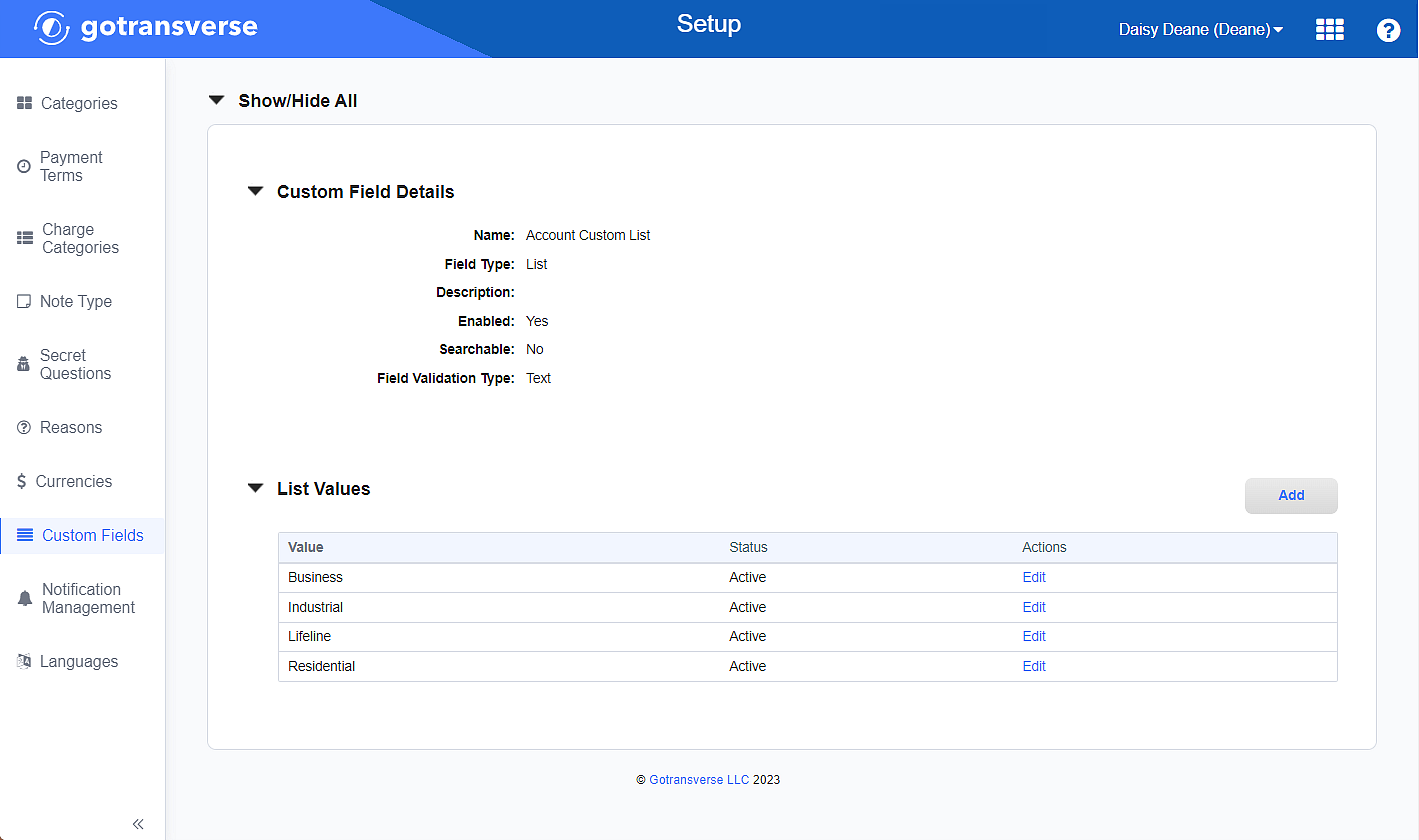

If you created a custom field of the List type, go to the Setup application’s Custom Fields module and navigate to the Custom Field Details window for that custom field. Then, click the Add button in the List Values section and add the following list values. These values will be included in the drop-down list when creating or editing a customer account. Refer to Add List Values for List Custom Field for more information about custom field list values in the Setup application.

-

Residential or R

-

Business or B

-

Industrial or I

-

Lifeline or L

Setup Application: Custom Fields Module - Custom Field List Values for Sales Type Code

Sales Type Code values require entering either a full word that begins with a capital letter or just the first capital letter of the type. For example, Residential or R. Values such as “residential” or “r” will not be recognized as Sales Type Codes.

-

-

If you created a custom field of the Text Field type, enter one of the sale types as the custom field value when creating or editing a customer account.

-

Complete the following steps to configure a SureTax Communications integration:

-

Select Admin from Gotransverse application menu

.

. -

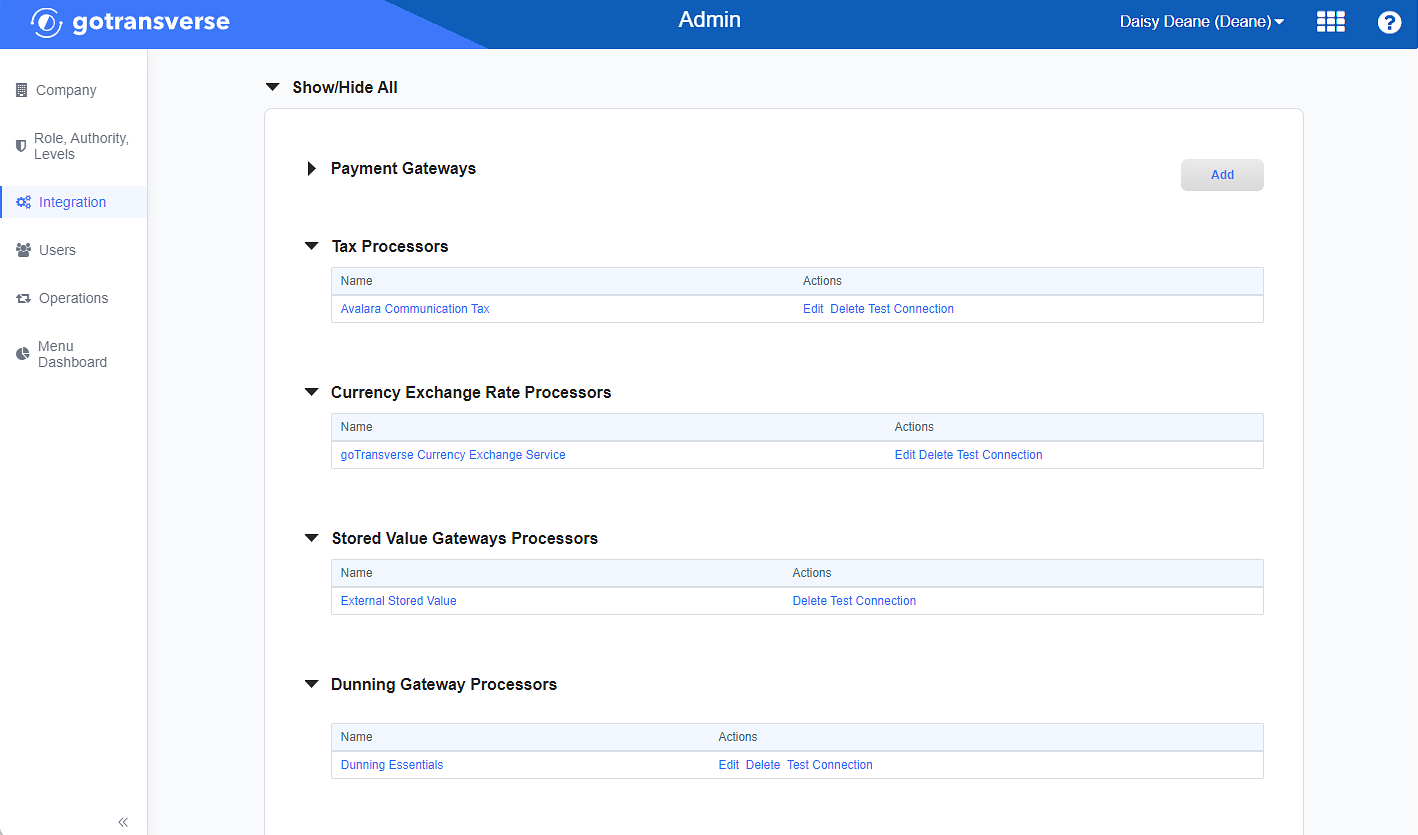

Click Integration in the left pane.

Integration Window

-

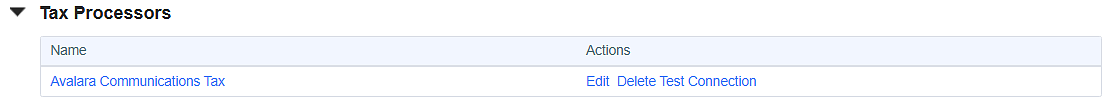

Locate the Tax Processors section.

Integration Window - Tax Processors Section

Click the

icon in the left pane to hide it. Click the

icon in the left pane to hide it. Click the  icon to open it.

icon to open it. -

Click the Add button to open the Add Tax Processor window.

-

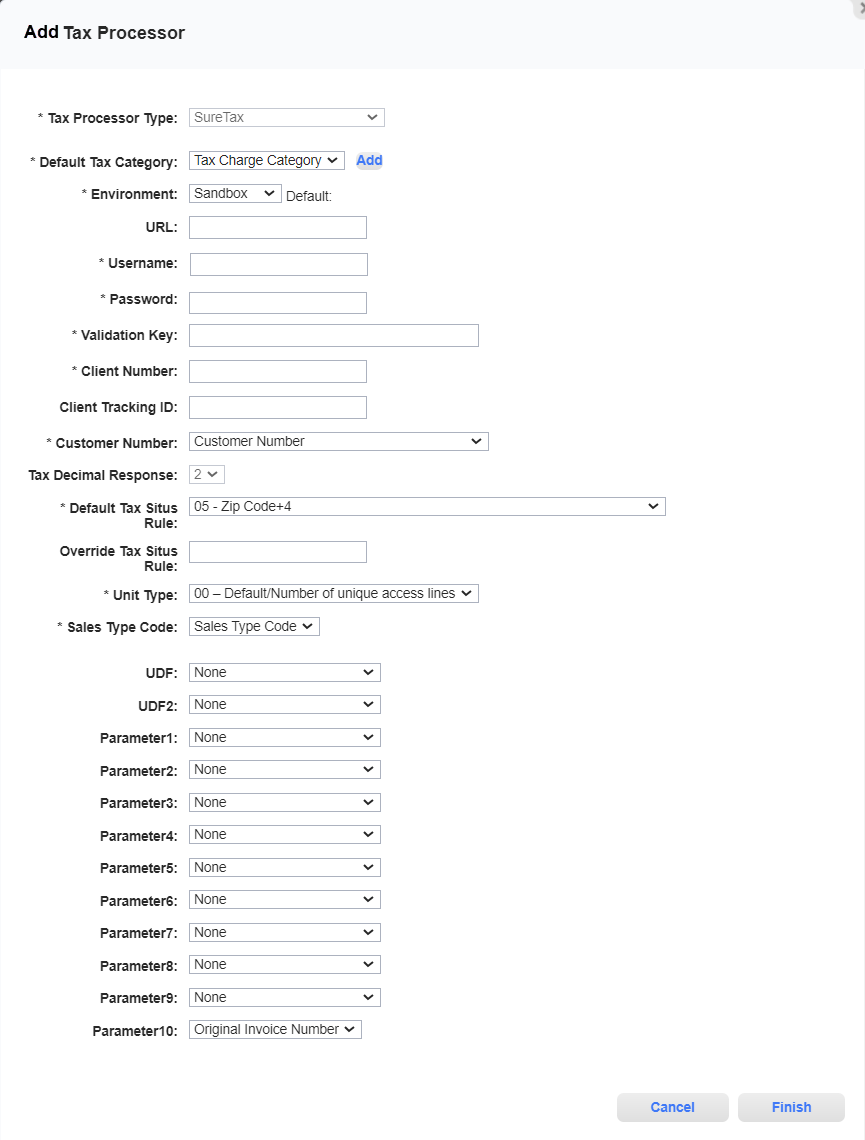

On the Add Tax Processor window, enter the required and relevant information:

Add Tax Processor Window - SureTax

Required fields are marked with an asterisk.

-

Tax Processor Type* — Select SureTax.

-

Default Tax Category* — Select a tax category that you have set up in the Charge Categories Module. If you have not yet created a tax category, click Add to create a new tax charge category at this time.

-

Environment* — Select an environment. Associated URLs will display to the right of the field after selection.

-

Sandbox: Any actions and changes are performed in a test environment and do not affect customers.

-

Production: Any actions and changes are performed in a production environment and affect customers.

-

-

URL — Enter the URL to override the default value selected in the Environment field. Use it when you need to specify the URL that differs from default Sandbox or Production URLs.

-

Username* — Enter the SureTax account login user name.

-

Password* — Enter the SureTax account login password.

-

Validation Key* — Enter the Validation Key provided by SureTax that is used for accessing the API.

-

Client Number* — Enter the Client ID Number provided by SureTax.

-

Client Tracking ID — Enter any value to be used for tracking the transaction.

-

Customer Number* — Select the value to be used as the Customer Number for the SureTax tax processor.

Customer Number is used by SureTax for identifying applicable tax exemption statuses managed on the SureTax side.

From the drop-down list, select the desired option:

-

Customer Number

-

External Customer Number

-

Billing Account Number

-

External Billing Account Number

-

Responsible Billing Account Number

-

External Responsible Billing Account Number

-

Responsible Customer Number

-

External Responsible Customer Number

-

Account Custom Field

-

-

Account Custom Field* — Required if you selected Account Custom Field in the Customer Number field. From the drop-down list, select the account custom field whose value will be used in the Customer Number field for tax calculation and tax exemption processing. This value provides a way to map a non-unique field in Gotransverse on the billing account level to the SureTax Customer Number field. Account custom fields are not required to be unique, unlike billing account, external numbers, and customer numbers. Custom fields are managed in the Setup application’s Custom Fields Module.

Account Custom Field values on both managed and child accounts are passed to SureTax separately from associated responsible or managed accounts.

The Account Custom Field value is sent in SureTax calls as the Customer Number field only after it is added on the desired billing account.

-

Tax Decimal Response — The number of digits to be used after the decimal point which determines the decimal precision for tax calculations. The default value is 2. Currently, you cannot change this value.

-

Default Tax Situs Rule* — Select the Tax Situs Rule that is the default method for determining the taxing jurisdiction. Options include:

-

05 - Zip Code+4 (ZIP+4). More granular than the ZIP code and can pick up County or City local taxes that are not applied to the ZIP code.

-

14 - Zip code field for international country code (used for VAT calculations). Select this option if using non-US addresses.

-

-

Override Tax Situs Rule — Optional. Enter a 2-character country code and “=05” or “=14” to override the Default Tax Situs Rule. Any country specified in the Override Tax Situs Rule field will use the tax situs rule specified here instead of the option selected in the Default Tax Situs Rule field. You can enter as many overrides as needed, separating each by a comma.

For example, if the default tax situs rule is 14 - Zip code field for international country code (used for VAT calculations) and you want to override it for certain countries, you would enter each of those countries’ country code and “=05”: US=05, MX=05, CA=05, etc.

Or if the default tax situs rule is 05 - Zip Code+4, you would enter each of those countries’ country code and “=14”: CA=14, CR=14, etc.

-

Unit Type* — Select the Unit Type code used for tax calculations. Currently, the only available value is 00 — Default / Number of unique access lines.

-

Sales Type Code* — Select the billing account custom field that was created to capture the R (Residential), B (Business), I (Industrial), or L (Lifeline) values for each account’s Sales Type Code value.

-

UDF /UDF2 — User-defined fields for use at the item level. This value is available for use in reports and extracts. Select from the existing Account or Service custom fields. The drop-down list displays the type of custom field and its name.

-

Parameter1 through Parameter9 — User-defined drop-down list of custom fields that are available for use in the rules engine. You can use these fields to provide additional information to SureTax by using the Account and Service custom fields. With different custom field types, you can pass various information such as additional addresses, dates, or notes. This way, SureTax receives additional information separate from the standard transaction data.

You can select from the existing Account or Service custom fields. The drop-down list displays the type of the custom field and its name.

-

Parameter10 — User-defined field that is available for use in the rules engine.

Currently, the Original Invoice Number value is selected by default, and you cannot change it. Sending an Original Invoice Number is useful for when reversals and reissues occur on invoices. This field provides additional information to SureTax of the original invoice from which the reversal or reissue actions originated. The SureTax Line Item Taxability with Location ID report includes the Parameter10 value sent in all committed tax calls.

-

-

Click Finish to save your configuration and close the Add Tax Processor window.