Flat Tax Processor Integration

Gotransverse provides the option of adding either a flat tax to your Tax Processor type or using a Tax Rate Service Provider. This section describes how to set up or edit a Flat Tax processor.

Review the following information before configuring the External Tax processor:

-

If you want to calculate the estimated tax on order, ensure that the Calculate Tax During Order Billing system setting is set to True. Refer to System Settings for more information about changing system settings.

-

Create at least one tax charge category. Refer to Charge Categories Module for more information.

This tax processor does not support tax calculations for Manual Charges. An error will occur and prevent a user from creating a manual charge with the Submit for Taxation checkbox selected.

Complete the following steps to configure a Flat Tax processor:

-

Select Admin from Gotransverse application menu

.

. -

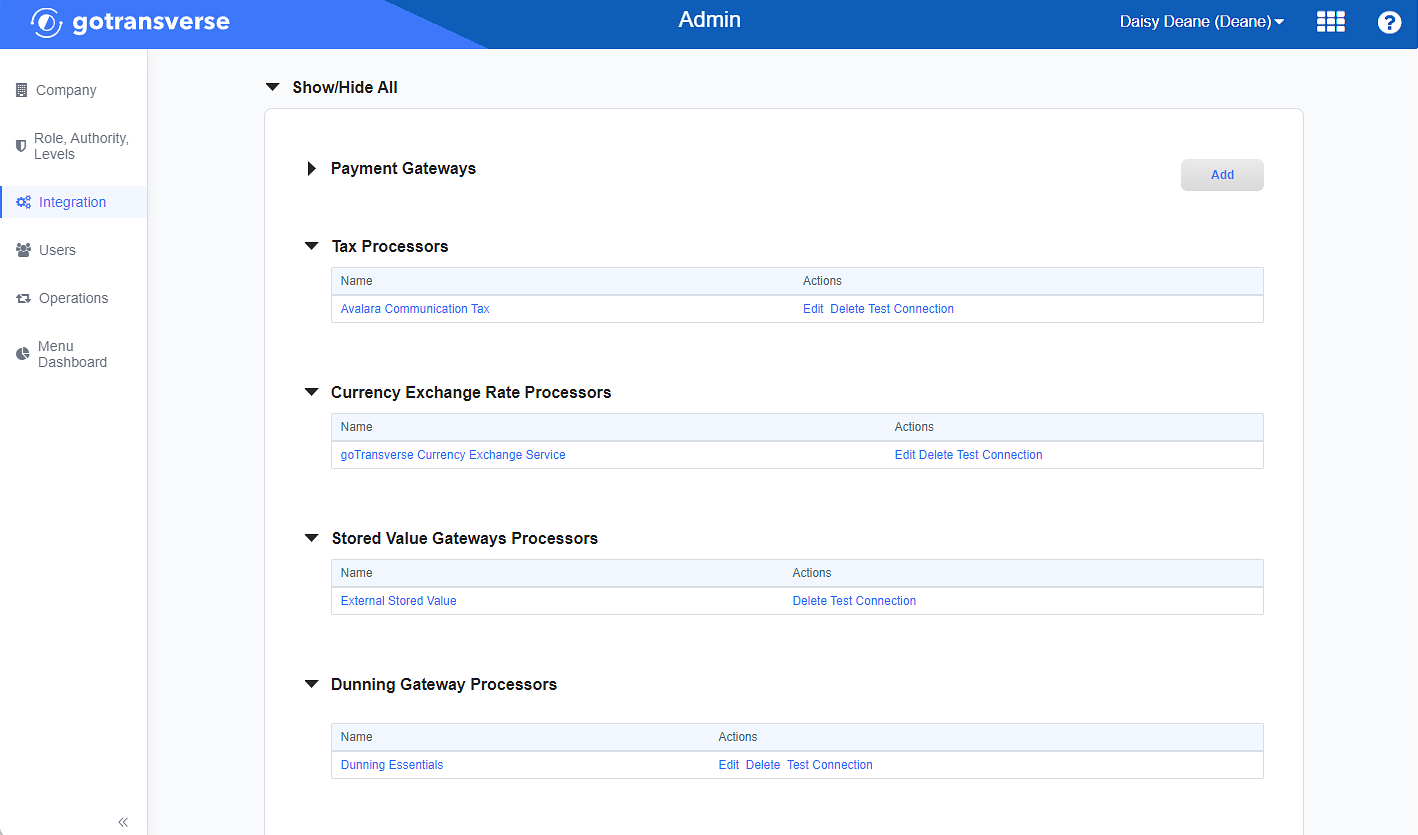

Click Integration in the left pane.

Integration Window

-

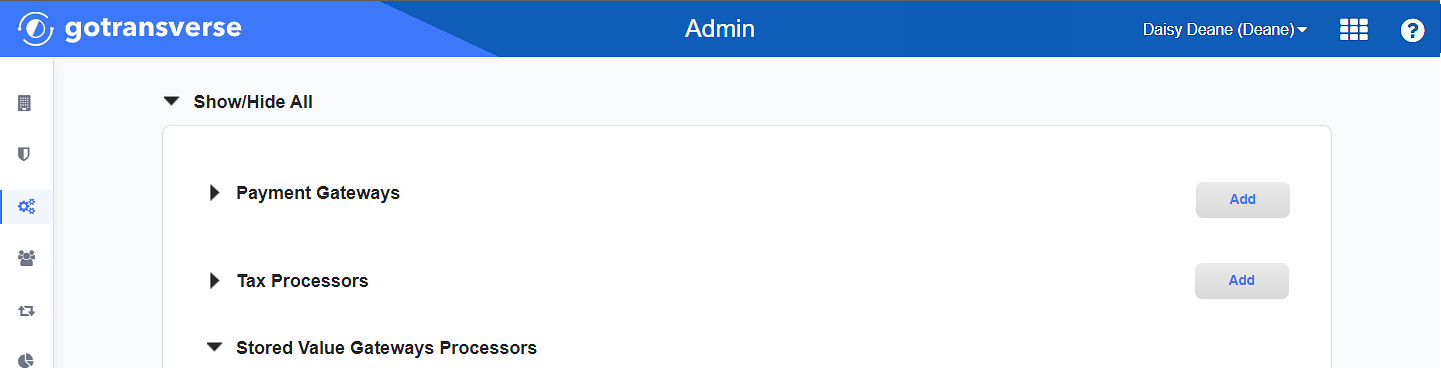

Locate the Tax Processors section.

Integration Window - Tax Processors Section

Click the

icon in the left pane to hide it. Click the

icon in the left pane to hide it. Click the  icon to open it.

icon to open it. -

Click the Add button to open the Add Tax Processor window.

-

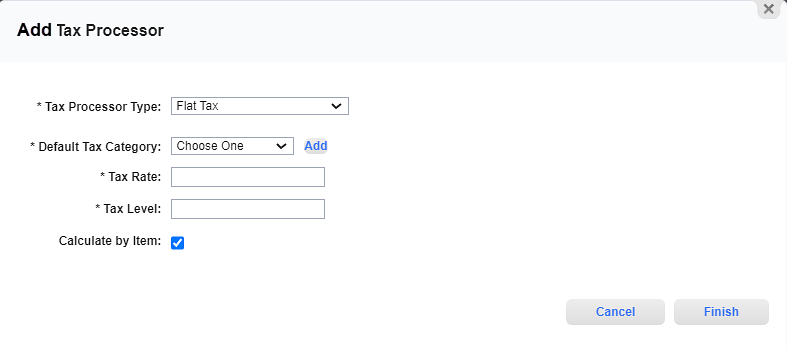

On the Add Tax Processor window, enter the required and relevant information:

Add Tax Processor Window - Flat Tax

Required fields are marked with an asterisk.

Tax Processor Type* — Select Flat Tax.

Default Tax Category* — Select a tax category that you have set up in the Charge Categories Module. If you have not yet created a tax category, click Add to create a new tax charge category at this time.

Tax Rate* — Enter the tax rate number in a percentage.

Tax Level* — Enter the number of the jurisdiction level being taxed.

Calculate by Item — Select this if you want taxes to be calculated by each invoice line item.

-

Click Finish to save your configuration and close the Add Tax Processor window.