Avalara Communications Tax Processor Integration

The Avalara Communication Tax processor enables complex tax and fee calculations that are unique to the communications industry. Avalara Communications tax processor also allows Tax Inclusive Pricing and Tax Exclusive Pricing to be configured in the same tenant.

NOTE: The Avalara Communications Tax tax processor integration uses Avalara Communications Tax v2 for new tax processor configurations. If you have an existing Avalara Communications Tax v2 integration, the integration name displays as Avalara Communications Tax (previously Avalara Communications Tax v2).

If you have an existing Avalara Communication Tax v1 integration, the integration name displays as Avalara Communications Tax-Legacy (previously Avalara Communications Tax). Avalara Communication Tax v1 integration is no longer available for new tax processor configurations

This tax processor supports tax calculations for Manual Charges.

Review the following information before configuring and using the Avalara Communications Tax integration:

-

Log in to Avalara AvaTax for Communications

and obtain the account information needed to configure the integration.

and obtain the account information needed to configure the integration. -

Ensure that the following system settings are configured (refer to System Settings):

-

Calculate Tax During Order is set to True.

-

Product Taxation Mode is set to the default taxation mode, which is the initial value for new items (can be changed later) in either the Product Catalog or Products applications. It is also used as the default tax mode for anything submitted via API without the Tax Mode specified.

-

Mandatory Billing Address is set to False.

-

Mandatory Service Address is set to True.

-

Determines whether to Use Billing or Service Address for Tax Calculations is set to SERVICE_ADDRESS.

-

-

Verify that you have at least one tax charge category. Refer to Charge Categories Module for more information.

-

Refer to Integration with Avalara Communication for additional information about this integration.

The Avalara Communications Tax integration requires a Permanent Location Code (P-Code) for each address used for tax calculations. Gotransverse populates the P-Code field when you add an address to a billing account or service. This code can be changed, if needed. Refer to Override P-Code of Customer Address.

Complete the following steps to configure the Avalara Communications Tax integration:

-

Select Admin from Gotransverse application menu

.

. -

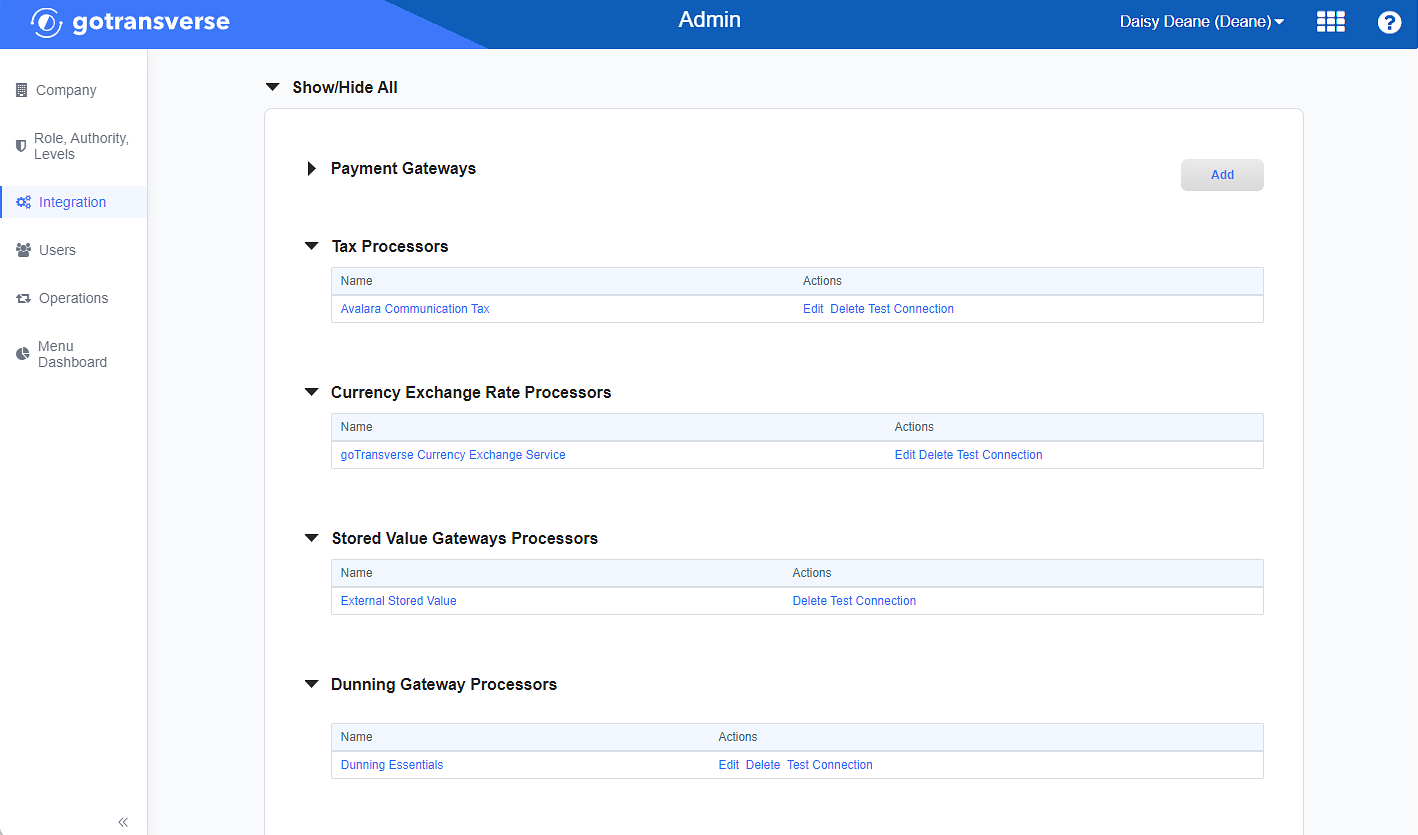

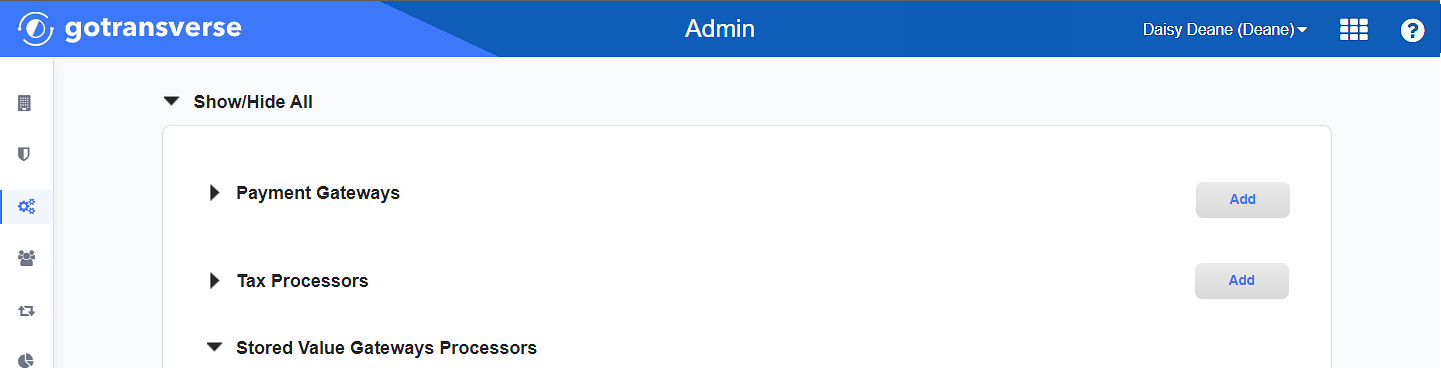

Click Integration in the left pane.

Integration Window

-

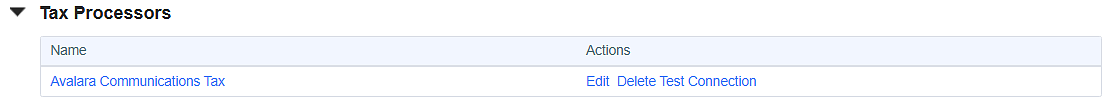

Locate the Tax Processors section.

Integration Window - Tax Processors Section

Click the

icon in the left pane to hide it. Click the

icon in the left pane to hide it. Click the  icon to open it.

icon to open it. -

Click the Add button to open the Add Tax Processor window.

-

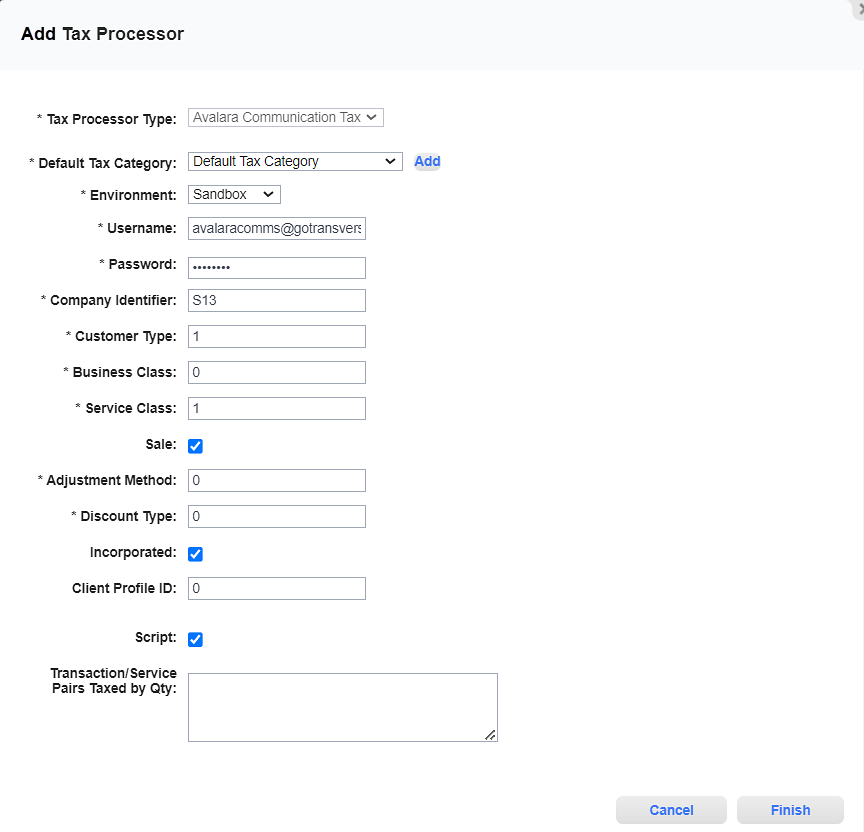

On the Add Tax Processor window, enter the required and relevant information:

Add Tax Processor Window - Avalara Communication Tax

Required fields are marked with an asterisk.

-

Tax Processor Type* — Select Avalara Communication Tax.

-

Default Tax Category* — Select a tax category that you have set up in the Charge Categories Module. If you have not yet created a tax category, click Add to create a new tax charge category at this time.

-

Environment* — Select one of the following:

-

Sandbox: Any actions and changes are performed in a test environment and do not affect customers.

-

Production: Any actions and changes are performed in a production environment and affect customers.

-

-

Username* — Enter the Avalara Communications account login user name.

-

Password* — Enter the Avalara Communications account login password.

-

Company Identifier* — Enter the company identifier provided by Avalara Communications.

-

Customer Type* — Enter the customer type provided by Avalara Communications.

-

Business Class* — Enter the business class provided by Avalara Communications.

-

Service Class* — Enter the service class provided by Avalara Communications.

-

Sale checkbox — Select the checkbox to send all transactions for tax calculation.

-

Adjustment Method* — Enter the adjustment method provided by Avalara Communications.

-

Discount Type* — Enter the discount type provided by Avalara Communications.

-

Incorporated checkbox — Select the checkbox to send all transactions for tax calculation only inside the city limits.

You can override this setting when adding or editing a Service address for the customer in the Customer Billing application. Refer to Add Address for more information about the override function.

-

Client Profile ID — Enter the client ID if you want to use a custom override file.

-

Transaction/Service Pairs Taxed by Qty — Enter the Transaction/Service Pairs (T/S Pairs) to be used for quantity based taxation. More than one set may be defined using a comma delimited list. Refer to Configure Transaction-Service Pairs for Tax Calculations for more information.

-

-

Click Finish to save your configuration and close the Add Tax Processor window.

Topic updated: 02/2024.