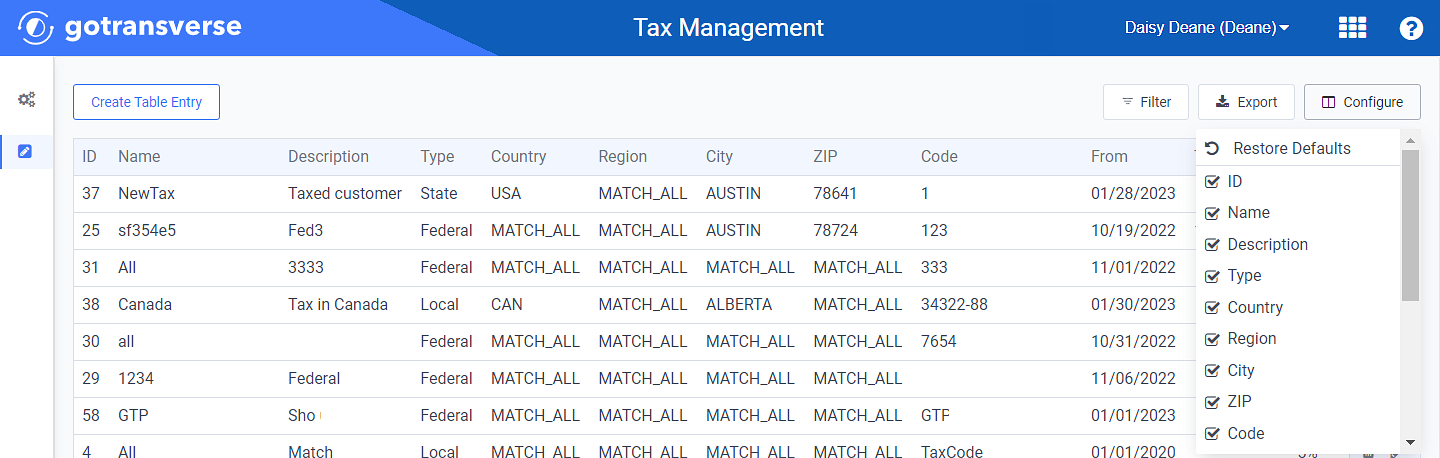

Filter, Configure, or Export Tax Table Entries

Complete the following steps to filter the tax table entries, configure which columns display in the tax table, or export the table entries shown:

-

Select Tax Management from the Gotransverse application menu

.

.

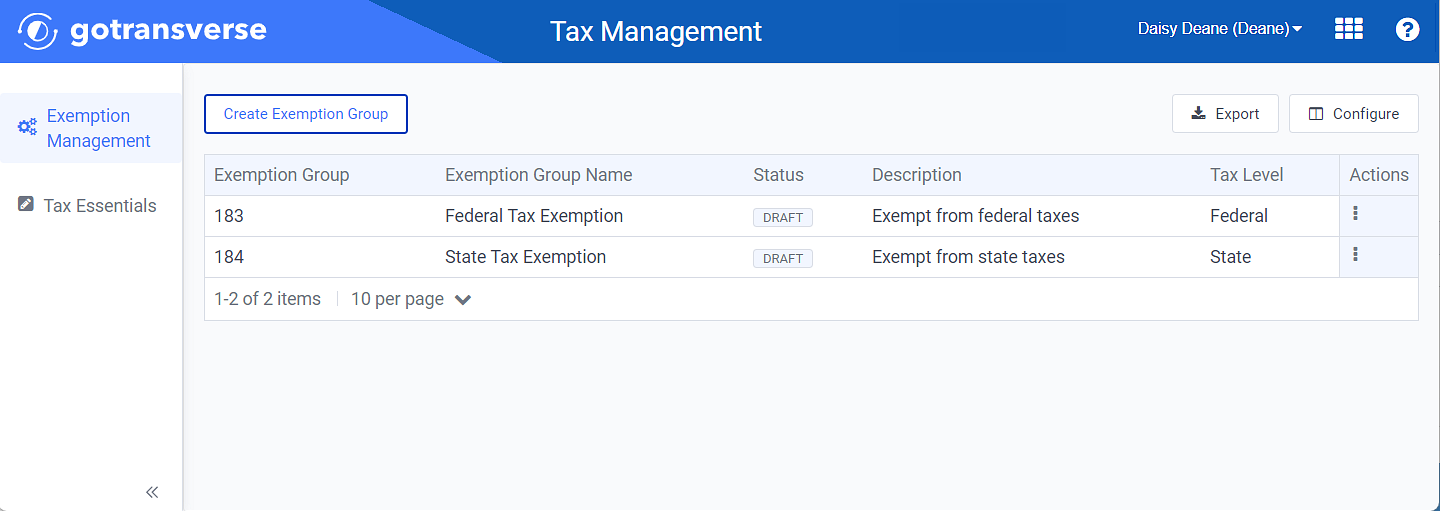

Exemption Management Window

Click the

icon in the left pane to hide it. Click the

icon in the left pane to hide it. Click the  icon to open it.

icon to open it.You can manage which columns display in any table with a Configure or Columns button by clicking the button and selecting desired columns. In addition. If the table includes a Filter button, you can filter the table contents. If the table includes an Export button, you can export visible table contents (up to 50) to a CSV (comma-separated values) file. Refer to Data Tables for more information about using these features.

-

Click Tax Essentials in the left pane.

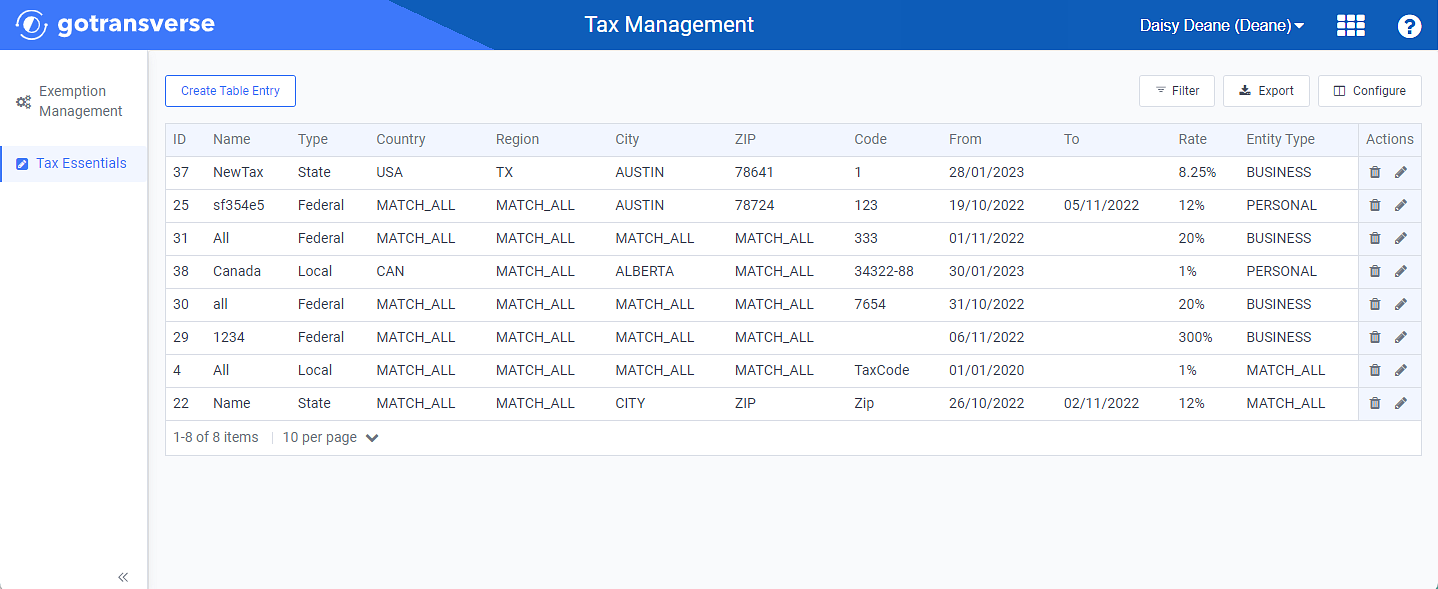

Tax Essentials Window

-

To filter the which records display in the table, click the Filter button to open the Tax Table Entries slide-out window.

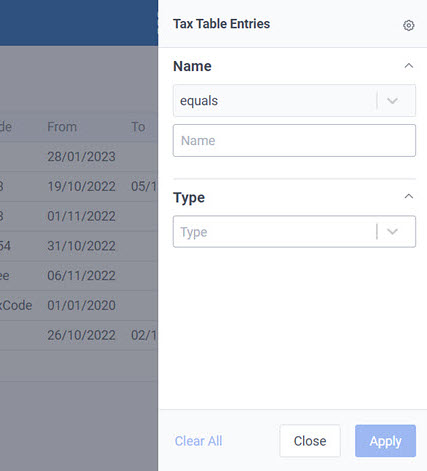

Tax Table Entries Slide-Out Window

-

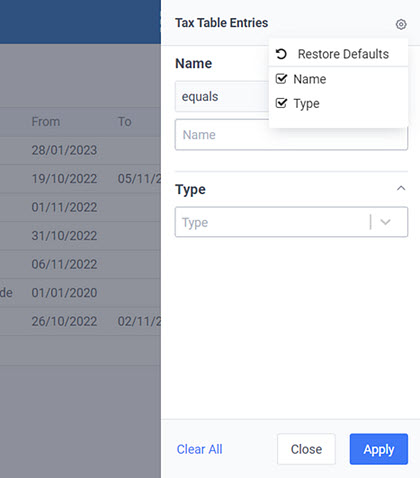

Click the

icon to select which filters are shown. Or click Restore Defaults to show default filters. Click outside the drop-down to close it.

icon to select which filters are shown. Or click Restore Defaults to show default filters. Click outside the drop-down to close it.

Configure Tax Table Entries Filters

-

Enter a Name and/or select a Type and click Apply.

-

Click Clear All to clear filters.

-

Click Close to close the slide-out window without applying filters.

-

-

To export the tax entries shown in the window in CSV format, click Export. The file is downloaded to your computer.

Only the records shown in the current view (maximum of 50 records) are exported. To export more or all records, change the number of records shown per page or export each page.

-

To configure which columns display in the table, click the Configure button and select column names. Use the scroll bar to see more column names. Click outside the menu to close it.

Configure Columns

To return to default settings, click Restore Defaults.

-

Name* — Name of tax table record.

-

Description* — Description of the tax table record.

-

Type* — The type of tax: Federal, State, or Local.

-

Country — Used for matching a taxable record to this table.

-

Region — Used for matching a taxable record to this table.

-

City — Used for matching a taxable record to this table.

-

ZIP — Used for matching a taxable record to this table.

-

Code* — Used for matching a taxable record to this table. The Code field refers to the Item Code on a charge category.

-

From Date* — The effective from date for the tax table record.

-

To Date —The effective to date for the tax table record.

-

Rate* — The tax rate, in percentage. For example: if the tax rate is 8.25%, enter .0825.

-

Location Code — Optional.

-

Company Code — Optional.

-

Entity Type* — Business, Personal, or Match All.

-