Revenue Management application produces journal entries for the day-to-day billing activity occurring in the platform. Revenue Management‘s posting rules can handle accounting scenarios unique to Subscription billing that might not exist in your ERP (Enterprise Resource Planning software) or would be time consuming to create manually, such as recognizing revenue daily over a service period. The application is designed to be flexible and ultimately create journal entries (transactions) that can be easily integrated with your existing accounting data by utilizing data extracts provided by Gotransverse or by using the GT-Connector service or Premier Data Access (refer to Premier Data Access for more information).

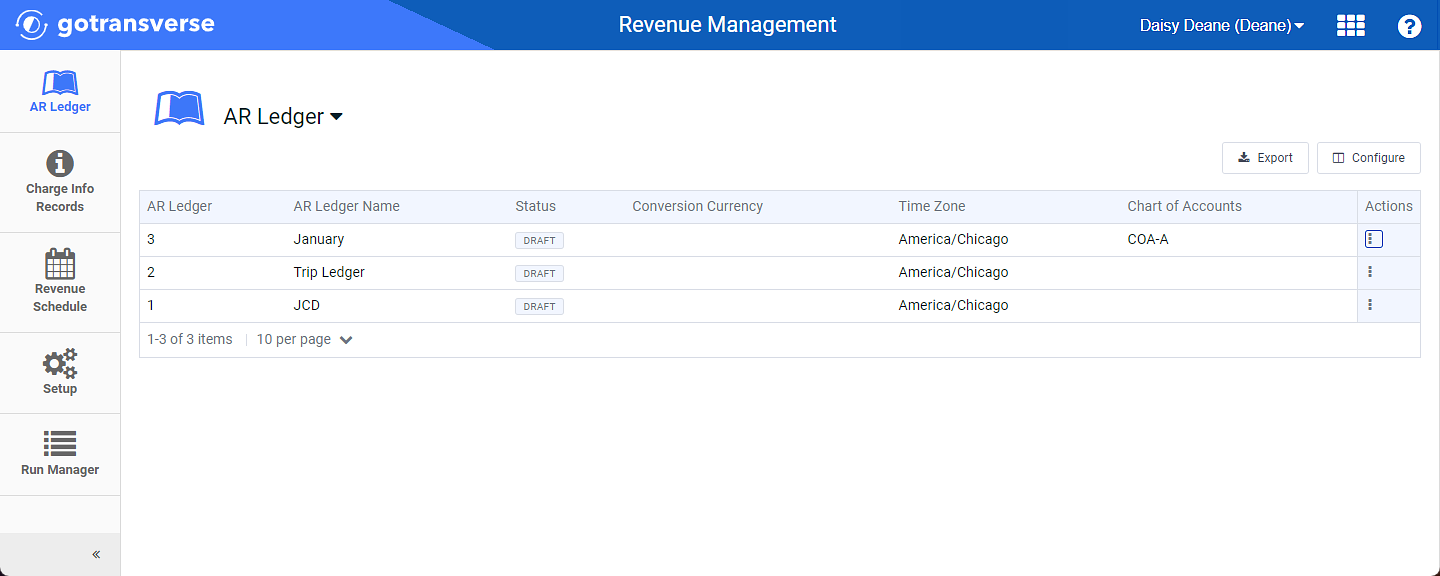

Revenue Management AR Ledger Window

Revenue Management consists of one or more accounts receivable (AR) ledgers. An AR ledger is designed to act as a sub-ledger for the AR activity in Gotransverse. Each AR ledger is customized using a client-defined chart of accounts, a posting rule set, and an accounting calendar.

-

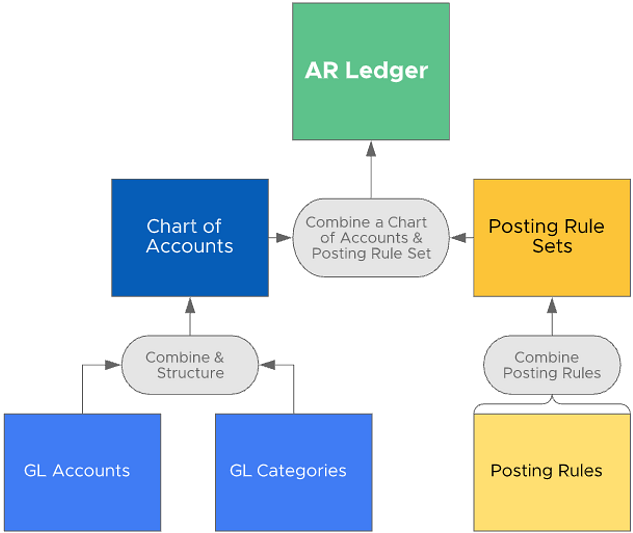

A Chart of Accounts (COA) is a collection of General Ledger (GL) accounts that are structured and categorized as part of Revenue Management. A COA is used to define which GL accounts can be used with an AR ledger.

-

A posting rule set is comprised of posting rules that are created from templates which were designed to capture all aspects of billing activity, ensuring all pertinent data is recorded as transactions, and your preferred revenue recognition policies are followed.

-

The accounting calendar of an AR ledger has accounting periods that can be open or closed to control the posting dates of transactions and can be customized to match your accounting periods.

Transactions can be sent to you as individual or aggregated entries. Gotransverse acts as the system of record for the aggregated transactions.

AR Ledger Work Flow Diagram

Revenue Management is a flexible application that allows you to create multiple AR ledgers, charts of accounts, and posting rule sets. Each AR ledger created can use a different combination of charts of accounts and posting rule sets to create transactions. Each AR ledger analyzes the same billing data. The transactions produced depend on the chart of accounts and posting rule set assigned to the AR ledger. This allows for AR ledgers that are useful for:

-

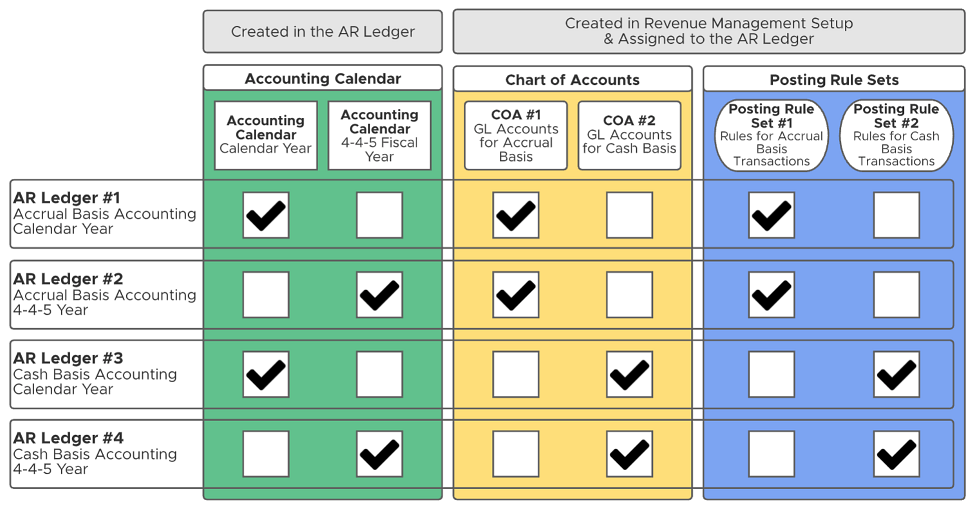

Comparing Accounting Methods — Assign different chart of accounts and posting rule sets to the AR ledgers similar to the image below.

-

Segmented Accounting — Postings rules are customized to produce transactions for a specific product line or division.

-

Multi-Entity Accounting — Separate AR ledgers are created and each are assigned a billing account category, which will limit the scope of the posting rules to charge info records with the specific billing account category.

The image below illustrates how you can compare cash and accrual basis accounting or compare different fiscal calendars by using multiple AR ledgers.

Revenue Management Multi-AR Ledger Diagram

Refer to the following topics for additional information about working in the Revenue Management application: