Payment Plans

A Payment Plan is a series of scheduled payments meant to pay off a customer’s past due invoices. A Payment Plan will remove a customer from a dunning plan and prevent future past due (delinquent) emails from being sent as long as the scheduled payment clears.

Payment plans are created and managed through a billing account as part of the collections process. Past due invoices are added to a customer-specified Payment Plan, along with due dates and amounts, to ensure timely payment collection or a promise to pay.

You can also set up auto-payment of scheduled payments in the Payment Plan if your customer has an auto-payment on file. The Customer Billing application allows you to create, edit, activate, delete, or cancel a Payment Plan.

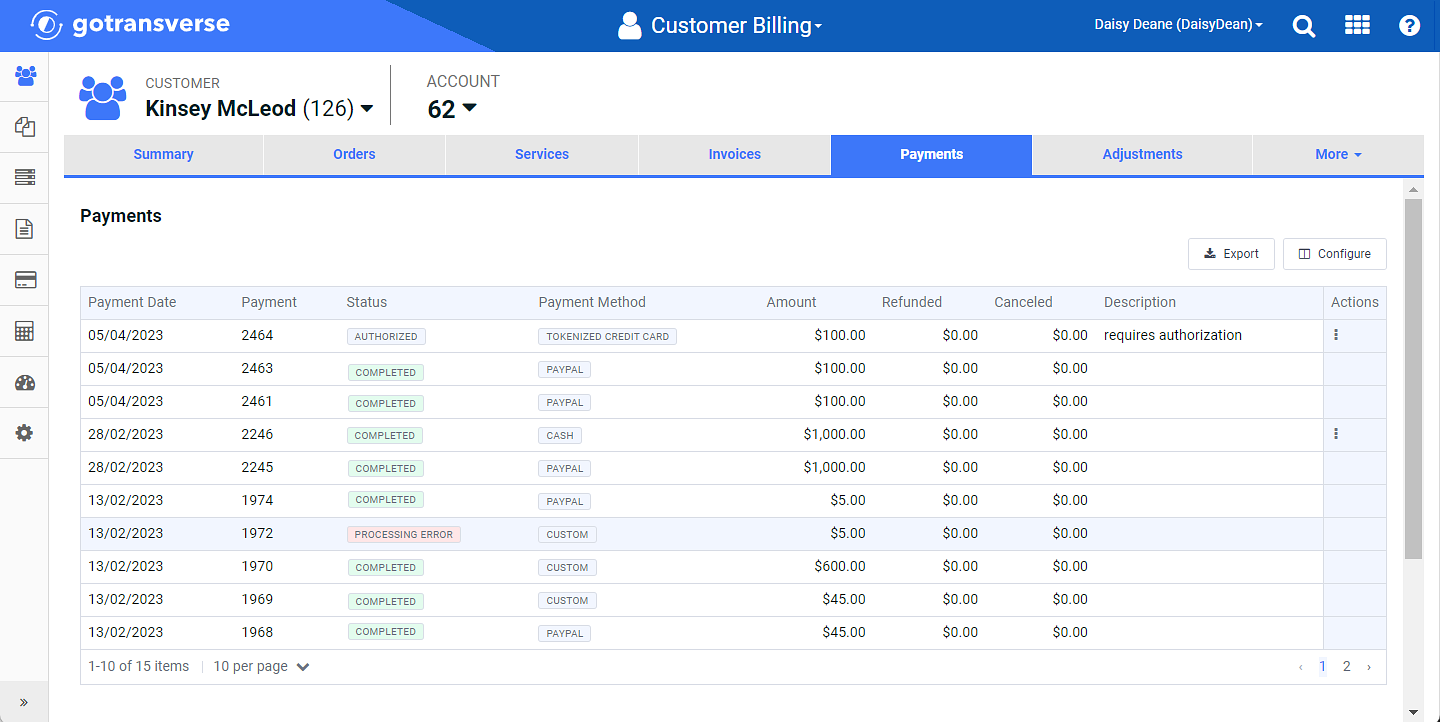

Payment plans are set up on the Account Details window, and all Payment Plans are listed under the Payments tab.

Account Details Window - Payments Tab

On the day a Payment Plan is activated, its scheduled payments are automatically set to a Scheduled status.

The Payment Plan feature can work in conjunction with existing dunning capability to help streamline the collections process. When invoice amounts for a billing account move to higher dunning tiers, causing billing account and services to be suspended or money owed to be written off, you may lose money and customers. Reaching out to the customer and working together to formulate a Payment Plan instead increases the possibility of collecting money owed and retaining customers. Invoices moved into a Payment Plan stop being evaluated by dunning. You can control which dunning tier the account moves to once invoices with remaining balances are reintroduced from a Payment Plan back into dunning.

Refer to Dunning for more information about dunning plans and tiers.

Refer to the following topics for additional information about creating and working with Payment Plans and notifications for your customers: